by Rashaid Hussain | Dec 5, 2024 | Latest

Overseas Pakistanis will now be required to obtain approval from the Commissioner Inland Revenue (FBR) to verify their non-resident status to qualify for the tax rates applicable to “filers” on immovable property transactions. The Federal Board of Revenue (FBR) has...

by Raashid Hussain | Nov 22, 2024 | Latest

Another attempt by FBR to take action against un-registered rich people including non-filers and nil-filers, targeting high net-worth individuals.In the first phase, the FBR will issue notices to 5,000 non-filers, with an estimated tax liability of Rs7 billion.These...

by Raashid Hussain | Nov 12, 2024 | Latest

ISLAMABAD: Directorate General of Intelligence and Investigation-Inland Revenue (IR) has prevented revenue loss of over Rs 16 billion by busting gangs/fraudsters using foreign IPs/VPN/Proxy Servers and “VPN/USA based” computer servers for declaring fake carry forward...

by Raashid Hussain | Nov 12, 2024 | Latest

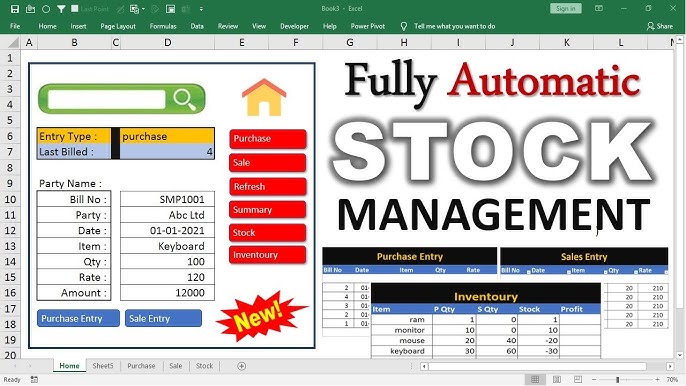

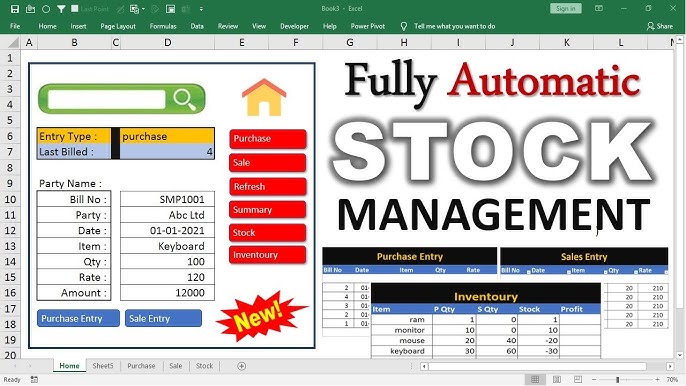

Under the direction of the Chairman FBR and as part of FBR’s comprehensive digitalization efforts to optimize tax administration and boost revenue collection, FBR has launched an advanced Stock Register system via the Information Center 2.0 platform. This robust...